10 Steps to Saving for a Down Payment on a House

How to Save Up for a Down Payment

Are you saving for a down payment on a home? Here are 10 tips to save up for a big down payment!

Let's start with some great news: You do not need 20% down to buy a house. In our market, here in Raleigh, North Carolina, and many other places, you can buy a home with 0% down.

A great way to build wealth over a period of time is through the building of home equity. This means that owning a home is one of the main requirements to build this equity. Many aspiring home buyers struggle to acquire the funds needed for their first down payment on a new home. Not a problem. This article lists the many steps a person can take to save the money needed to do just that. Often, many people choose to save for a house while renting.

One of the biggest single purchases an individual will likely make during their lifetime is purchasing a home. When dealing with the prospects of buying real estate, understanding the full ins and outs of the process should be of the utmost importance. Knowing the total cost and what you can afford will help you avoid foreclosure and put you in a great position. This will enable you to prepare for your future purchase properly.

When closing the deal on your new home, a one-time payment will be made in cash, referred to as a "down payment." As your mortgage payments each month and the initial value of your home equity are determined by your down payment, it's crucial to understand the long-term financial effect it can have on you and your budget.

Buying a home is not for everyone. In my local market, Raleigh, North Carolina, you shouldn't be afraid to pull the trigger on a house. It will be a good investment if it's near a decent deal. Many people want to buy a home and will never execute because they fear pulling the trigger or making a mistake. Making a mistake in a strong market like Raleigh is much harder.

You should consider your timeline when deciding if renting or buying is your best option. One well-known concept and rule to live by is that to reconcile all transaction fees and closing costs associated with purchasing a home, you must own it for about five to seven years. It should go without saying that since prices and costs vary from one location to the next, the exact time frame will depend on the area you choose to reside in.

To assist with figuring out the costs between renting and buying, numerous online calculators have been created that can be used completely free. You should take advantage of these to gain great insights that can be beneficial in helping you decide on the best course of action.

One little-known fact is that the actual seller can decide to pay for the closing costs. How much they pay can vary, but it isn't uncommon to find sellers who pay the entire closing cost or, at the very least, a portion. This will help you, as the buyer, recover any costs you had to pay in a shorter time span.

It's important to keep this one fact in mind: The bigger the amount of your down payment, the more money you'll likely save long-term. Follow the following tips to save up for that bigger down payment.

Chapters

1. Decide on a Goal

The first step you should take when you start to save up for that down payment is figuring out exactly how much you'll need. Make an appointment with a mortgage lender. He or she will not only tell you the amount needed as a down payment, but they will also be able to educate you on how much you'll be able to prequalify for regarding a home loan.

As a rule of thumb, after calculating your monthly income, the expenses for your house should not be greater than 28% of that. With an income of about $5,000 monthly, about $1,400 should be set aside as part of your future down payment if you didn't understand the math, $5000 x 28% = $1400.

The $1,400 is made up of a variety of things such as interest incurred on the mortgage along with the mortgage's principal amount, PMI also referred to as Private Mortgage Insurance, HOA fees (Home Owner's Association) if applicable, taxes for Real Estate, and even Homeowner's Insurance.

2. Figure Out Your Timeframe

Next on the list of steps is to figure out your timeframe.

Remember that since you're saving this money for a specific purpose, it shouldn't be saved in other investments if you want to buy a house. Store your funds in a separate bank account if it will help you avoid the temptation of withdrawing.

We know you'll be able to obtain a higher return on your money by investing in things such as stocks and real estate, but doing so exposes you to unnecessary risks. You don't want to lose all the money you've been saving for so long. You want to buy a house. It's okay to miss out on those potential returns because you'll also miss out on those losses.

3. Allow Room in Your Budget

Considering that we're talking about putting thousands of dollars to the side every year, it's necessary to create a budget that will allow you to do so. This might even require gaining some extra income, lowering your expenses wherever possible, or possibly both.

This may require you to get rid of some of your expenses completely. This can be a good thing because not only will it assist you in saving your down payment money and get you accustomed to dealing with the tight budgets that many homeowners have to work with. You'll be more prepared than expected when the time comes.

4. Create an Automatic Savings Plan

Automating the process will be useful if saving money isn't your specialty. With the assistance of payroll saving plans such as 401(k)s, you can effortlessly withdraw a specified dollar or percentage from your paycheck into the account. There are also other accounts, such as regular savings and Money Market accounts, where your money can be directly deposited from your paychecks that can be used to build your down payment savings.

The great thing about this process is that it's completely hands-free after the initial setup. It is so effective that you don't even see the money, so you don't miss it from your paycheck. These "invisible" savings make it easier to continue to do so. The desire to spend the funds you should save is removed from your mind.

5. Save All of That Extra Cash

The process of saving the down payment money can become easier, along with the shorter timeframe, by saving all extra cash received. Add all extra income to your down payment savings, such as tax refunds, commissions, bonus checks, lottery winnings, cash gifts, etc. You'll be happy you did in the long run.

You will be amazed by how fast that down payment accumulates when you follow this tip. Don't be surprised you've knocked a few years off your previously calculated timeframe.

6. Pick Up a Side Hustle

The gig economy is one of the best ways to earn extra money on your own time. Picking up a side hustle is a fantastic way to utilize your skills and unique talents to boost your income. Some of the best side hustle ideas include becoming a freelancer, dog walking, babysitting, online tutoring, or driving for a rideshare company.

7. Make Sure Your Savings Plan Is Flexible

Regardless of how much your down payment is, you'll want to be certain that your savings plan is flexible. Life throws plenty of unexpected situations. These can have a huge impact on your budget and finances. Medical emergencies, car problems, loss of employment, and even family matters can cause a hit to your funds. Just because you have goals you are trying to reach doesn't mean life won't throw some unexpected situations your way. Ensure a spot in your budget is dedicated to these exact situations.

As long as you prepare for these potential issues in advance, you'll be able to deal with them as they come without being deterred from your goal of saving for that down payment. The problems will be solved, and your down payment funds will continue growing. No matter the unexpected issue, you'll still find yourself in a win-win position. Just remember to make sure this part of your budget always has funds.

In all reality, this is nothing more than preparation for being a homeowner. All of your current expenses will still exist when you buy a home. You might even have some additional home-related ones as well. By practicing this tip now, you'll be more than capable of handling them just as well with the added responsibilities of homeownership.

8. Determine What You Will Be Able to Afford

Common sense would tell you that before starting your search for a home, you should know what you'll be able to afford. Don't be afraid of talking with a mortgage lender. After determining that, look to see if you can find what you'd like in that price range.

To figure out what's affordable, remember to factor in all of the previously mentioned costs and fees, such as Homeowner's Insurance, Gas, Water, Electricity, Real Estate taxes, mortgage payments each month, etc.

If you're part of a couple or will be sharing the expenses with someone else, it'd be a good idea to find a home you like that'll be able to have all of the expenses taken care of with just one paycheck.

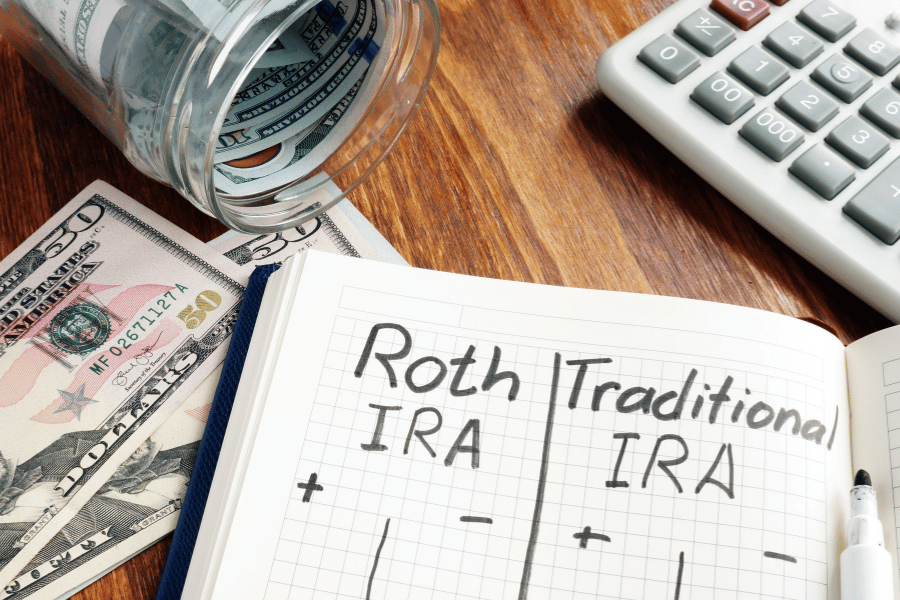

9. Using Your IRA to Purchase Your First Home

First-time homeowners can receive a certain tax break from the IRS. You can withdraw up to $10,000 from your IRA to purchase or build your first home for you and any loved ones at any age, completely penalty-free.

One thing that should be remembered is the $10,000 cap is a lifetime one. It's not per year. If married, both spouses can use the $10,000 cap. This equals $20,000 between the both of them. One of the stipulations is that you'd have to use the funds within 120 days of withdrawing it.

Another thing to note is that there are two types of IRAs. One is a traditional IRA; you must pay taxes on any funds you withdraw. The other is a Roth IRA. This type of IRA allows you to withdraw funds completely tax-free. Because it'll be tax-free, the account must be open for at least 5 years before you withdraw funds from it.

Discussing IRA withdrawals with a certified tax professional is highly recommended before taking any funds out. They can provide you with all its pros and cons and advise you on the proper action.

10. Building Wealth Through Building Equity

You've finally accumulated the funds needed to pay that new home down. Congratulations. You are officially a homeowner now. The next thing to make sure you understand is that you're now in the process of building equity.

As you make more and more mortgage payments, you'll acquire more and more property. Not only will your property value increase, but your equity will also increase. Because of this, if you decide to sell your home, you'll probably have a down payment larger than the initial one you started out with. This is one of the ways that you'll be building your wealth.

FAQs

How do you budget for a downpayment on a house?

The best ways to budget for a downpayment on a house include planning your budget, increasing your income, cutting unnecessary spending, and paying off debt.

How much should you save for a downpayment on a house?

It is ideal to save enough money to put down a 20% downpayment on the home price to avoid paying private mortgage insurance and to help lower monthly mortgage payments.

Final Thoughts on Saving for a Down Payment

One of the more difficult parts of buying a house is having enough cash to ensure you can afford both the down payment and the closing costs. If you have limited funds, you can still buy a house you have to be more strategic about which loan program you use, as well as how you structure the deal for the sellers. There are a lot of great programs for first-time buyers.

There are many ways in which the sellers can contribute funds to your closing costs in the form of cash back at closing. Many buyers will utilize this strategy when purchasing a home with limited funds because it allows them some breathing room after they move in.

Ryan Fitzgerald

Hi there! Nice to 'meet' you and thanks for visiting our Raleigh Real Estate Blog! My name is Ryan Fitzgerald, and I'm a REALTOR® in Raleigh-Durham, NC, the owner of Raleigh Realty. I work alongside some of the best Realtors in Raleigh. You can find more of my real estate content on Forbes, Wall Street Journal, U.S. News and more. Realtor Magazine named me a top 30 under 30 Realtor in the country (it was a long time ago haha). Any way, that's enough about me. I'd love to learn more about you if you'd like to connect with me on Facebook and Instagram or connect with our team at Raleigh Realty. Looking forward to connecting!

Related Blogs